Why Small Businesses in Zambia Need Accounting Software

In today's fast-paced business environment, small businesses face many challenges, from managing finances and compliance to keeping track of inventory and customer relationships. In Zambia, where the economy is growing, and entrepreneurship is booming, accounting software emerges as an essential tool for small businesses. By streamlining financial management, improving accuracy, and enhancing decision-making, accounting software can be a game-changer for small enterprises in Zambia. In this blog post, we will explore the various reasons why small businesses in Zambia should invest in accounting software, particularly highlighting key features that can make a significant impact.

1. Streamlined Financial Management

For many small business owners in Zambia, managing finances can be daunting. They often find themselves juggling various financial responsibilities, including bookkeeping, tax compliance, and financial reporting. The complexity of these tasks can consume valuable time and resources.

Accounting software simplifies financial management by automating many of these processes. It allows business owners to easily record transactions, track income and expenses, and generate financial reports with just a few clicks. This saves time and minimizes the risk of human error, ensuring more accurate financial records.

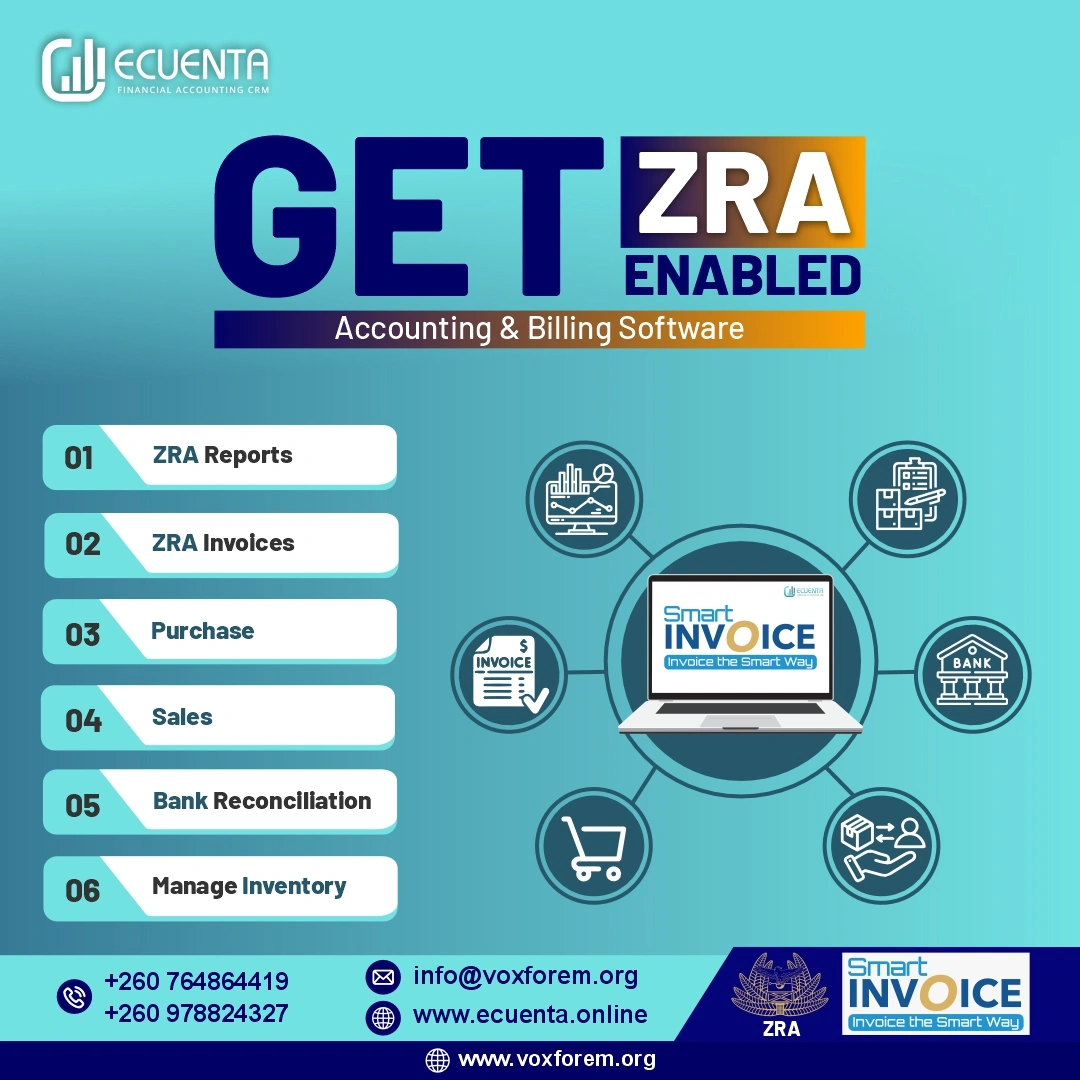

2. Smart Invoicing

Accounting software with ZRA Smart Invoicing significantly benefits small businesses invoicing process, ensuring compliance with tax regulations, and reducing the risk of errors. It allows for quick and efficient generation of digital invoices that are reported in real-time to the Zambia Revenue Authority, simplifying tax filings. This leads to faster payments, improved cash flow, and better financial management. The streamlined processes save time and reduce administrative burdens, enabling small business owners to focus more on growth and customer service while maintaining accurate and transparent financial records.

3. Secure Online Payments

In today's digital world, customers expect convenience, including the ability to pay invoices online. Accounting software often offers integrated secure online payment options, enabling customers to pay via credit cards or payment platforms like PayPal or mobile money solutions, which are popular in Zambia.

This capability streamlines the payment process and reduces the time it takes for businesses to receive funds. Additionally, secure online payments can greatly enhance customer satisfaction, as clients appreciate the ease of handling transactions.

4. Simple Expense Tracking

Tracking expenses is crucial for maintaining profitability, but for many small business owners in Zambia, it can be a cumbersome task. Accounting software simplifies expense tracking by allowing users to record expenses immediately as they are incurred.

With an easy-to-use interface, businesses can categorize expenses, attach receipts, and even set budgets for specific projects or departments. This visibility into spending empowers business owners to make informed decisions and identify areas where costs can be trimmed, thus fostering a healthier bottom line.

5. Bank Reconciliation

Bank reconciliation is a necessary process that ensures a business's financial records match its bank statements. However, manual reconciliation can be time-consuming and prone to errors. Accounting software makes it easier for small business owners in Zambia to keep their financial records accurate.

By linking bank accounts directly to the software, transactions are automatically imported, making it straightforward to reconcile accounts. This feature not only saves time but also helps identify discrepancies promptly, minimizing potential cash flow issues.

6. Enhanced Cash Flow Management

Cash flow is the lifeblood of any business, and managing it effectively is crucial for small businesses in Zambia. Delays in payments or poor inventory management can lead to cash flow problems that threaten a business's survival.

Accounting software aids in cash flow management by providing tools to track receivables and payables. With features like smart invoicing and secure online payments, business owners can easily monitor outstanding invoices, set payment reminders, and forecast cash flow needs. This level of control allows them to make timely decisions to ensure liquidity and operational continuity.

7. Project Management Features

For small businesses that operate on a project basis, effective project management is essential. Several accounting software solutions come with built-in project management features that allow users to track project expenses, monitor progress, and evaluate profitability.

This feature enables businesses to allocate resources more effectively and make informed decisions about project bids and timelines. Having a clear understanding of project-related finances can lead to better pricing strategies and, ultimately, increased profitability.

8. Complete Inventory Control

Inventory management can be critical for businesses that sell products, especially those with limited storage space. Accounting software that includes inventory control features empowers small business owners to manage their stock levels effectively.

With complete inventory control, businesses can track stock levels in real-time, set reorder points, and manage suppliers all within the same platform. This functionality minimizes the risks of overstocking or stockouts, enhances operational efficiency, and helps maintain customer satisfaction.

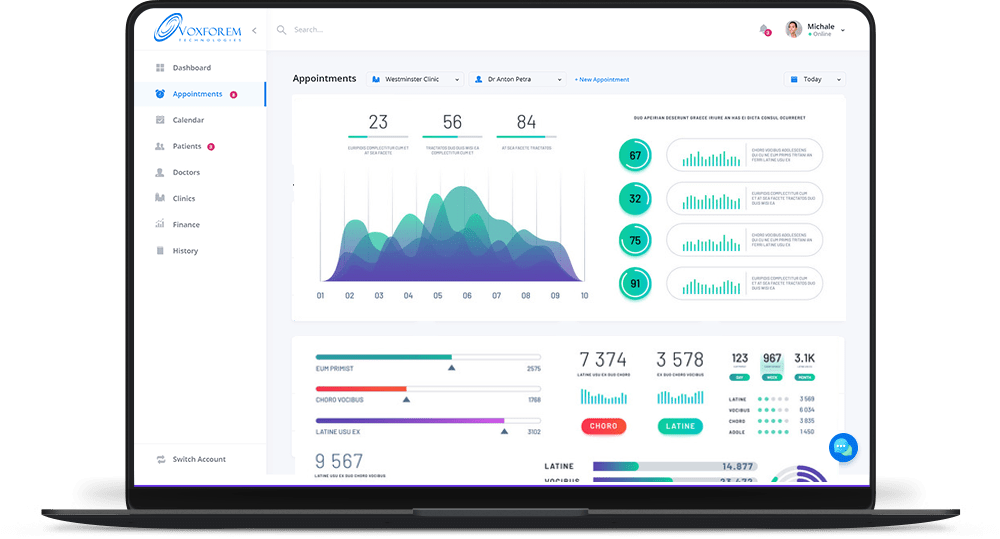

9. Integration with Other Business Tools

Today’s small business landscape is increasingly interconnected, with many business owners relying on multiple software solutions for various aspects of their operations. The ability of accounting software to integrate with other tools—such as customer relationship management (CRM) systems, inventory management software, and e-commerce platforms—can enhance overall efficiency.

For instance, integrations with sales platforms can automate the process of updating revenue and expenses, ensuring that financial records reflect accurate transaction data. This interconnected approach can help streamline various business processes and improve overall productivity.

10. Enhanced Data Security

Data security is a growing concern for businesses worldwide, including in Zambia. Handling sensitive financial data without the right protections can expose businesses to fraud and cyber threats.

Accounting software often comes with robust security features that help safeguard financial information. Many solutions offer data encryption, secure access controls, and regular backups, ensuring that financial records are protected from unauthorized access and potential loss.

11. Scalability for Growth

As small businesses grow, their accounting needs become increasingly complex. Without the right tools in place, managing this growth can become overwhelming. Accounting software is designed to be scalable, allowing businesses to start with basic features and expand their capabilities as their needs evolve.

Whether it's adding more users, incorporating advanced reporting tools, or integrating with other business systems, accounting software can adapt to the size and complexity of the business, ensuring that it continues to provide value as the enterprise grows.

Conclusion

In summary, small businesses in Zambia face unique challenges that can be effectively addressed through the use of accounting software. From streamlining financial management and improving accuracy to enhancing cash flow management and providing valuable insights for decision-making, accounting software offers a multitude of benefits.

With features like smart invoicing, secure online payments, simple expense tracking, bank reconciliation, project management capabilities, and complete inventory control, investing in accounting software is not just a choice; it's a strategic move toward a more efficient and successful business operation.

As Zambia continues to grow as a hub for entrepreneurship, the importance of accounting software cannot be overstated. Small businesses must leverage these tools to enhance their financial management and unlock their full potential. By embracing technology and innovation, they will position themselves for sustained growth and success in the competitive business landscape.