ZRA Smart Invoicing: All You Need to Know About Zambia's Electronic Billing System

In today's digital age, the demand for efficient, transparent, and streamlined processes has never been more pressing—especially in tax administration. This is where the Zambia Revenue Authority (ZRA) steps in, offering an innovative solution known as ZRA Smart Invoicing. This electronic billing system enhances tax compliance and makes invoicing processes more manageable for businesses operating in Zambia. In this blog, we will explore everything you need to know about ZRA Smart Invoicing, its features, benefits, and how it is transforming the landscape of tax compliance and business operations in Zambia.

What is ZRA Smart Invoicing?

ZRA Smart Invoicing is an electronic billing platform designed to facilitate the generation, issuance, and management of invoices more efficiently. The system enables businesses to create invoices that are compliant with Zambian tax regulations, thus promoting transparency and accountability in tax reporting. This electronic solution revolutionizes the traditional invoicing process, allowing businesses to manage their invoicing needs through a digital interface.

Key Features of ZRA Smart Invoicing

1. Real-Time Invoicing:

With the ZRA Smart Invoicing system, businesses can create and send invoices instantly. This feature helps streamline cash flow, as prompt invoicing can lead to quicker payments from customers.

2. Tax Compliance:

One of the core benefits of the ZRA Smart Invoicing system is its built-in compliance with Zambian tax laws. The system automates the process of calculating tax amounts and generating invoices that meet the requirements set by the ZRA, thus minimizing the chances of errors and penalties.

3. E-Archiving:

All invoices generated through the system are automatically archived in the cloud, making it easy for businesses to retrieve past invoices and maintain accurate records for audits or reviews.

4. User-Friendly Interface:

ZRA Smart Invoicing is designed with an intuitive user interface that simplifies the invoicing process. Users do not require extensive training to navigate the platform, making it accessible for businesses of all sizes.

5. Integration with Other Systems:

ZRA Smart Invoicing can integrate with other financial and accounting software, allowing for seamless data management across different business operations.

6. Enhanced Security:

The security features embedded in ZRA Smart Invoicing safeguard sensitive business and tax information. Data is encrypted and protected against unauthorized access, ensuring compliance with privacy laws.

7. Multi-Currency Support:

Recognizing the realities of international trade, the platform supports multiple currencies, allowing businesses engaged in cross-border transactions to issue invoices in their preferred currency.

Benefits of ZRA Smart Invoicing for Businesses

1. Increased Efficiency:

By automating the invoicing process, businesses can save time and reduce the administrative burden associated with manual invoicing methods. This increased efficiency allows business owners to focus on core operations rather than getting bogged down by paperwork.

2. Reduction in Errors:

Manual invoicing is often prone to human error, which can lead to discrepancies and compliance issues. The ZRA Smart Invoicing system significantly reduces the risk of such errors, ensuring accurate calculations and compliance.

3. Faster Payments:

The immediacy of electronic invoicing can lead to quicker payment cycles. Businesses can follow up on unpaid invoices more effectively, improving their cash flow and financial health.

4. Better Record Keeping:

The e-archiving feature ensures that businesses maintain proper documentation of all transactions, which is crucial during audits or tax assessments. This digital organization also allows businesses to retrieve past invoices without sifting through piles of papers.

5. Improved Customer Relations:

By issuing professional, timely invoices, businesses can foster good relationships with their customers. The ZRA Smart Invoicing platform allows for personalized invoices that can enhance customer satisfaction.

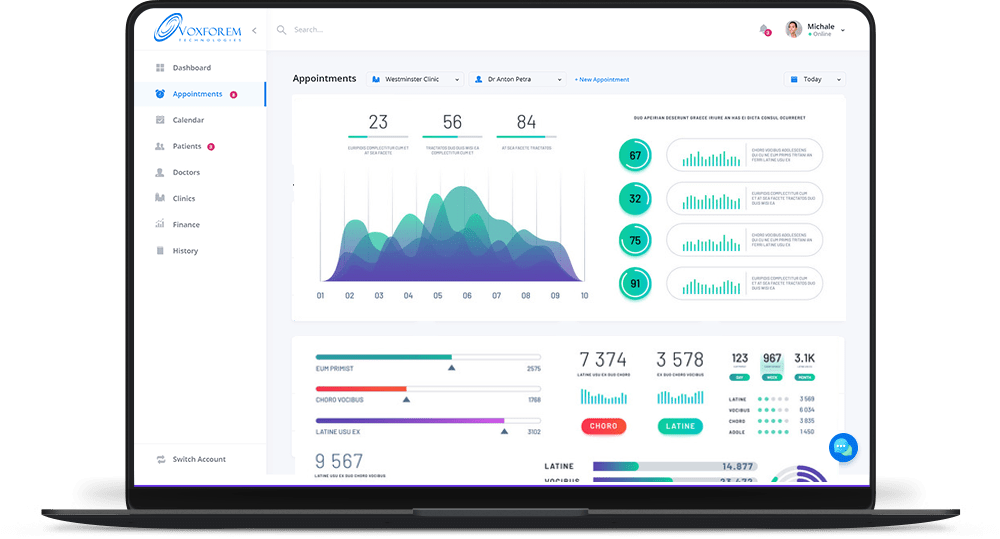

6. Access to Analytics:

The system provides users with insights into invoicing trends and patterns, allowing businesses to better understand their operations and make informed decisions.

The Role of ZRA Smart Invoicing in Tax Compliance

Tax compliance is essential for any business as it ensures adherence to local regulations and promotes fair competition. ZRA Smart Invoicing plays a crucial role in enhancing tax compliance in Zambia through the following ways:

- Standardized Invoicing:By providing a template for compliant invoices, the system helps eliminate confusion regarding tax calculations and compliance requirements.

- Automated Tax Calculations:ZRA Smart Invoicing automatically computes Value Added Tax (VAT) and other taxes, reducing the likelihood of errors that can lead to penalties.

- Increased Transparency:Electronic invoicing promotes visibility in the invoicing process, making it easier for ZRA to monitor transactions and enforce compliance.

- Easier Audit Trails:The archived invoices provide a clear record for both businesses and tax authorities, simplifying the audit process and enabling quicker resolutions for any discrepancies.

How to Get Started with ZRA Smart Invoicing

For businesses interested in leveraging ZRA Smart Invoicing, the starting process is straightforward:

1.Registration:

Businesses must register on the ZRA's official website and create an account.

2.Training:

While the platform is user-friendly, ZRA may provide training resources or webinars to help businesses familiarize themselves with the system.

3.Integration:

Depending on the existing financial systems a business uses, it may require integration for seamless data transfer.

4.Implementation:

Once set up, businesses can begin generating invoices, tracking payments, and enjoying the various benefits that the system offers.

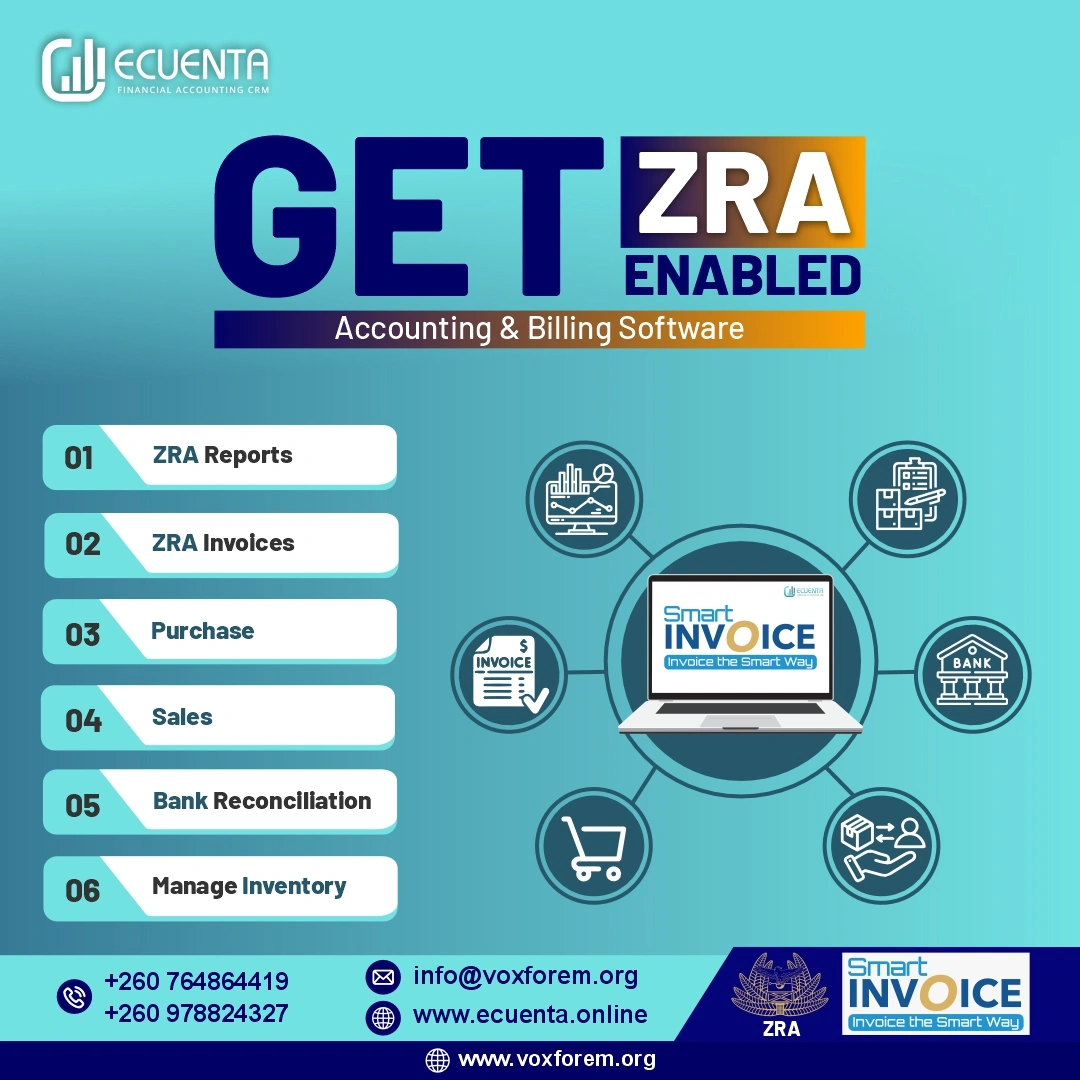

How Ecuenta ZRA Smart Invoicing Helps Businesses in Zambia

1. Seamless ZRA Integration

Ecuenta Smart Invoicing connects effortlessly with ZRA requirements, ensuring easy compliance for businesses.

2. User-Friendly Interface

The intuitive design allows for quick adaptation and minimal training, speeding up the onboarding process.

3. Customization Options

Businesses can tailor invoicing templates and processes to fit industry-specific needs while adhering to tax regulations.

4. Process Automation

Ecuenta automates invoice creation, sending, and tracking, reducing administrative workload and minimizing errors.

5. Comprehensive Financial Management

The system integrates sales, purchasing, and inventory management for better overall financial oversight.

6. Real-Time Reporting

Get immediate insights into invoicing and tax reporting for effective cash flow management and decision-making.

7. Enhanced Security

Robust security features protect sensitive data, ensuring compliance with data protection regulations.

8. Ongoing Support

The Voxforem Development team provides continuous support and updates to ensure compliance with changing ZRA regulations.

Conclusion

ZRA Smart Invoicing represents a significant advancement in how businesses in Zambia can manage invoicing and tax compliance. By adopting this electronic billing system, businesses can improve efficiency, gain better control over their finances, and ensure compliance with Zambian tax laws. As the corporate landscape continues to evolve, embracing technological solutions like ZRA Smart Invoicing is no longer optional—it’s a necessity for any forward-thinking business looking to thrive in a competitive environment. If you haven't explored ZRA Smart Invoicing yet, now is the time to embrace this innovative tool and take your invoicing processes to the next level.