How Bookkeeping Software Can Benefit Companies in Zambia

Managing finances is a fundamental aspect of running any business, but it can be a daunting task for many entrepreneurs. Bookkeeping, in particular, can be a time-consuming and complex process, especially for small business owners who may not have a dedicated accounting department. However, with the help of technology, there are now software solutions available that can make bookkeeping easier and more efficient.

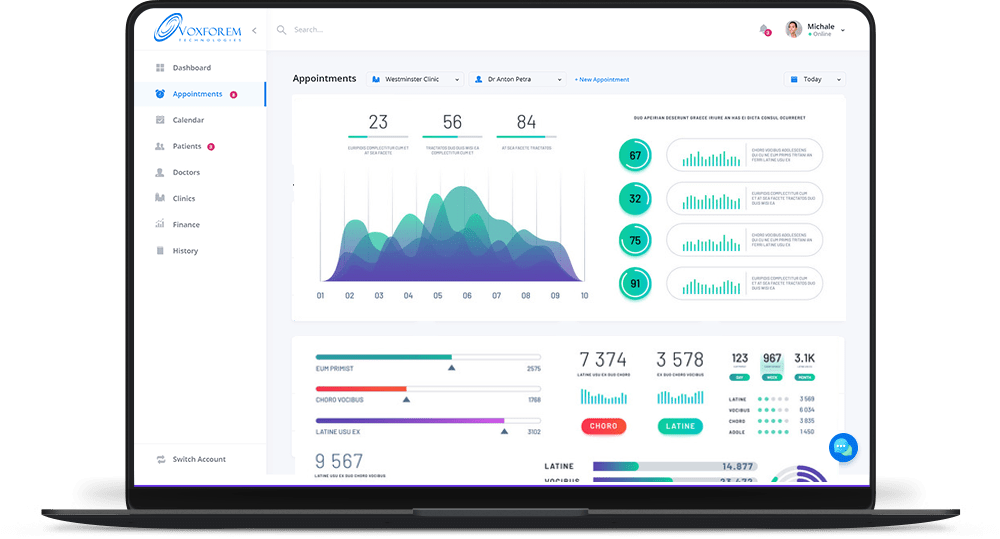

If you are a business owner in Zambia, you should consider using the best bookkeeping software designed specifically for Zambian companies. This software simplifies the challenging process of maintaining financial records by offering a user-friendly interface for tracking expenses, creating invoices, and documenting transactions.

With this software, you can easily monitor your cash flow, view your financial statements, and generate reports with just a few clicks. The software is designed to be user-friendly, so even if you have no prior experience with bookkeeping, you can use it with ease.

One of the main benefits of using bookkeeping software is that it saves time. Instead of spending hours manually updating spreadsheets and tracking expenses, you can automate the process and focus on other aspects of your business. Additionally, the software reduces the likelihood of errors, which can be costly in the long run.

Bookkeeping software can greatly improve a business's financial management by streamlining processes, reducing errors, and providing real-time insights. This is particularly beneficial for companies in Zambia, where investing in the right software can help them focus on core competencies and strategic growth.

Selecting the best software available is key to unlocking the full potential of bookkeeping software for businesses.

The Benefits of Bookkeeping Software for Your Business

Accuracy and Efficiency: Automating repetitive operations such as data entry and verification can ensure financial record accuracy and greatly reduce the time and effort required to maintain them. This can help you avoid errors and save time, allowing you to focus on other aspects of your business.

Real-Time Financial Insights: With bookkeeping software, businesses can access immediate accounting data and insights, allowing managers to monitor revenue, expenses, cash flow, and the overall accounting process in real-time. This can help you make better-informed decisions and stay on top of your finances.

Organization and Accessibility: Bookkeeping software organizes financial data systematically, making it simple to access and search when needed. This can make regulatory compliance easier and auditing procedures more efficient.

Cost Savings: While there may be an initial expenditure associated with installing and purchasing bookkeeping software, there will be significant long-term cost reductions. Software automation also saves time, freeing staff members to concentrate on higher-value duties that advance the company's growth.

Scalability: Bookkeeping software is designed for companies of all sizes, from small startups to major corporations. This makes it scalable, meaning it can grow with your business.

Security and Backup: bookkeeping software systems include strong security safeguards that protect important accounting data against cyber threats and unauthorized access. This can give you peace of mind knowing that your financial data is secure.

Here are some benefits of selecting the appropriate bookkeeping software for your business

- Accurate Financial Records

By automating complex calculations and reducing the possibility of human error, the right bookkeeping software ensures the accuracy of financial records. This is especially important when it comes to tax season or preparing financial statements.

- Customizable to Business Needs

Effective bookkeeping software can be tailored to meet the unique requirements of a company, offering customization options that take into account the nuances of different financial operations and industry standards.

- User-Friendly Interfaces

The best bookkeeping software should have simple-to-use and user-friendly interfaces. This is crucial, especially for those without a background in accounting. It also helps save time and reduces the chance of errors.

- Integration Capabilities

The best bookkeeping software works in conjunction with other important company tools, such as banking apps, payroll software, and invoice generation. This helps keep all your financial data in one place, making it easier to manage.

- Scalability for Growth

As your business grows, you need software that can handle higher transaction volumes and expanding data requirements. Scalable bookkeeping software can grow with your business and adapt to your changing needs.

- Real-Time Financial Insights

Access to real-time financial data is critical when making strategic decisions. The right bookkeeping software provides you with the information you need to make informed decisions.

- Cost-Efficient Operations

While the initial cost of purchasing the appropriate bookkeeping software may be high, the long-term cost savings are significant. Investing in the right bookkeeping software can help you save time, reduce errors, and streamline your financial operations.

- Enhanced Security Measures

The best bookkeeping software comes with strong security features that protect private financial data from online threats and unauthorized access. This is crucial in today's world, where data security is a top concern for businesses of all sizes.

In conclusion, bookkeeping software can help businesses manage their finances more efficiently and accurately, leading to better financial decision-making. It saves time, improves accuracy, and reduces costs, making it a valuable investment for businesses of all sizes. Choosing the right software is crucial, as it can be tailored to meet the unique requirements of a company, offer customization options, and provide real-time financial insights. By implementing bookkeeping software, businesses can focus on other aspects of their operations, knowing that their financial data is secure and organized.