From Paper Chaos to Digital Clarity: A Zambian Business Story

In early 2024, Mwila ran a mid-sized construction supply business in Ndola. Her shelves were stocked, her invoices printed manually, and her accountant swamped. Delays in VAT returns, misplaced receipts, and countless hours spent reconciling tax reports were a monthly headache. But everything changed when the Zambia Revenue Authority (ZRA) rolled out its Smart Invoice system and mandated electronic invoicing for VAT-registered businesses.

Initially skeptical, Mwila adopted the system using a ZRA Integrated Accounting Software solution recommended by her provider. By mid-2025, her invoicing process was streamlined, VAT claims were processed faster, and business audits were stress-free. Her team saved over 20 hours a month in admin time.

Like Mwila, thousands of Zambian businesses are undergoing a digital transformation. Let’s explore how the ZRA Smart Invoice system works, what’s new in 2025, and how your business can benefit.

What Is the ZRA Smart Invoice System?

The ZRA Smart Invoice system is a cloud-based electronic invoicing platform introduced by the Zambia Revenue Authority in March 2024. It allows real-time transmission of invoices and inventory data directly to ZRA’s servers, ensuring transparency, faster processing, and simplified tax compliance.

As of July 1, 2024, all VAT-registered businesses in Zambia are legally required to issue invoices through this system (ZRA, 2024). Non-compliance after the grace period (which ended on September 30, 2024) can result in penalties and denied input VAT claims.

From January 1, 2025, only invoices generated via the Smart Invoice platform are eligible for VAT refunds.

2025 at a Glance: Smart Invoice by the Numbers

The impact of the system has been substantial:

- 36,650+ businesses registered on the Smart Invoice system.

- Over 84.8 million invoices issued through the platform as of mid-2025.

- An average of 2,300 invoices per business

- 100% of VAT input claims in 2025 must be linked to a verified Smart Invoice

These numbers highlight the rapid national shift toward digital tax compliance.

How Does the Smart Invoice System Work?

Businesses issue invoices through one of four approved platforms:

- Mobile App: For small traders and rental tax users

- Web Portal: Ideal for service-based companies with fewer transactions

- Desktop App: For non-ERP users needing offline capability

- ERP Integration (VSDC): For medium and large businesses using ZRA Integrated Accounting Software

Each invoice is:

- Automatically submitted to ZRA in real-time

- Assigned a unique Mark ID and QR code for authenticity

- Used to update inventory records and sync financials

Key Benefits of ZRA Smart Invoice for Businesses

1. Tax Compliance Made Easy

No more scrambling for lost receipts. Invoices are digitally submitted and instantly verified. ZRA has access to real-time transaction data, reducing audit risks.

2. Faster VAT Refunds

Since ZRA can verify invoices instantly, refund processing times have decreased by 40% on average for compliant businesses.

3. Integrated Inventory Management

The Smart Invoice system tracks goods sold and services rendered, helping businesses avoid stockouts, monitor margins, and simplify procurement.

4. Fraud Reduction

Fake invoices are now nearly impossible to process, thanks to the invoice verification system. Each buyer can scan the QR code to confirm legitimacy.

5. Operational Efficiency

By using ZRA Integrated Accounting Software, businesses report 20–40% savings in administrative time, according to recent ERP user feedback published by EDICOM (EDICOM, 2025).

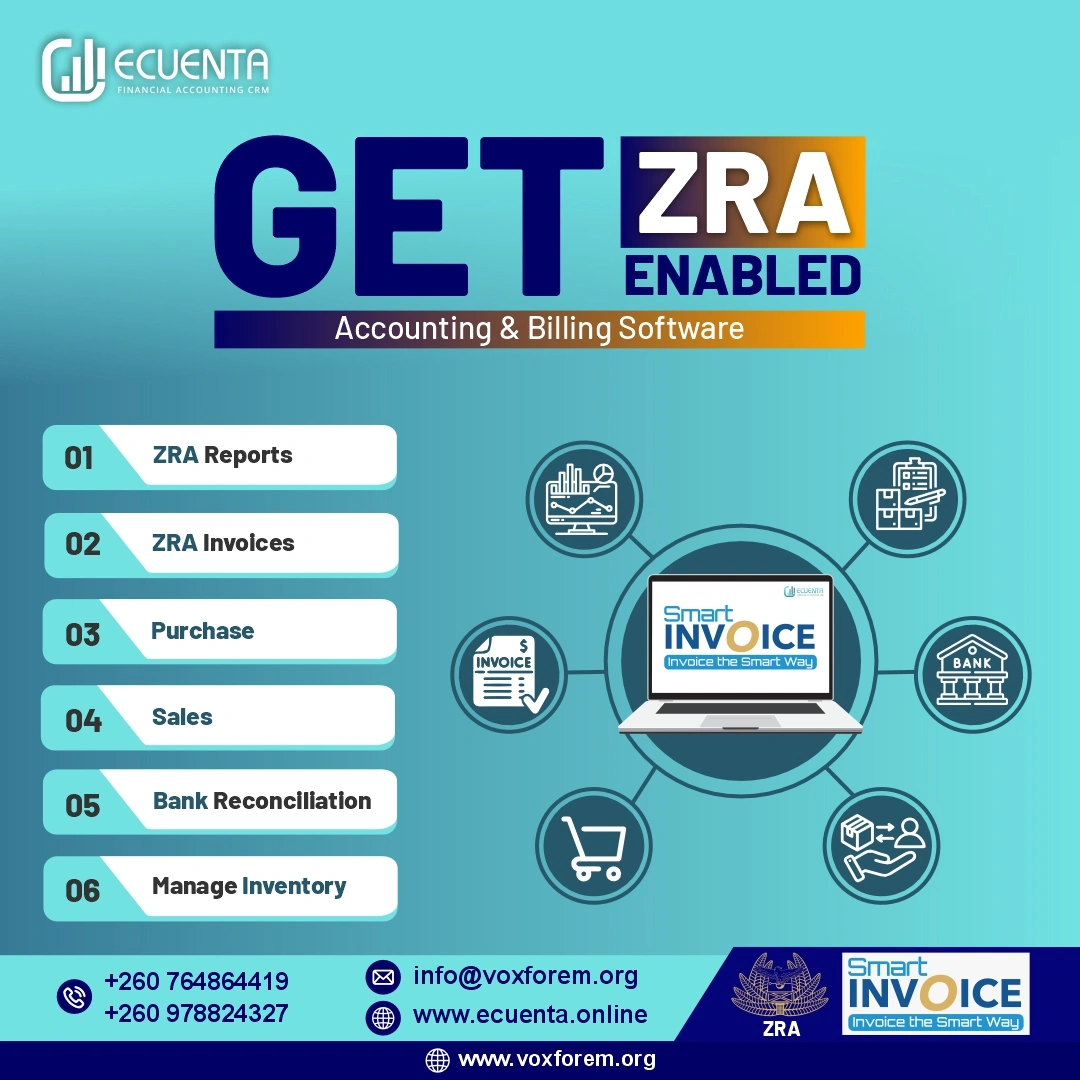

The Role of Accounting Software in Zambia

The adoption of Accounting Software in Zambia has skyrocketed post-mandate. Businesses are now shifting to cloud-based solutions that are certified to work with ZRA’s Smart Invoice APIs. This includes local and global provider like: Ecuenta Smart Billing Accounting Software with ZRA integrated is built with user experience in mind and offers complete support for filing ZRA tax returns. It includes specialized modules tailored for managing financial records, tracking expenses, and ensuring compliance with ZRA standards. With its smart invoicing capabilities, the system streamlines billing processes and guarantees accurate, regulation-ready invoice generation.

The tool not only help with invoice generation but also automate:

- VAT computation

- Report submission

- Inventory reconciliation

- Sales trend analysis

Businesses that adopt integrated tools are far better equipped to remain compliant and competitive.

Challenges Businesses Still Face

While the system has been a success overall, not all businesses have experienced a smooth transition. Common issues include:

- Internet access limitations in rural regions

- Lack of awareness and technical training

- Inadequate hardware (e.g., older devices incompatible with apps)

- Language barriers in training resources

Organizations and local tech consultants have urged ZRA to expand support programs and offer low-cost training to micro and small enterprises.

Steps to Stay Compliant in 2025

Here’s how you can ensure your business stays compliant and benefits from Smart Invoice in 2025:

- Register for Smart Invoice on the ZRA portal

- Choose the appropriate platform (mobile, web, desktop, or ERP)

- Adopt ZRA Integrated Accounting Software

- Train your staff using ZRA’s official user guides and tutorials

- Track inventory and VAT in real-time

- Subscribe to ZRA updates to stay informed on regulatory changes

Looking Ahead: What’s Next?

ZRA has hinted at future enhancements to the Smart Invoice ecosystem, including:

- AI-based audit automation

- E-wallet and POS integrations

- Advanced analytics dashboards

Businesses that invest early in compliant systems and automation tools will be best positioned to grow, scale, and collaborate across borders.

Final Thoughts: Embrace the Digital Shift

The ZRA Smart Invoice system isn’t just a compliance obligation—it’s a game-changer for business operations in Zambia. From tax automation to inventory control, the system empowers companies to work smarter, faster, and with full visibility.

Whether you’re a retailer in Chipata or a logistics firm in Lusaka, integrating with Accounting Software in Zambia that supports ZRA protocols is no longer optional—it's your strategic advantage.

Just like Mwila, whose business operations transformed through digital invoicing, your business too can benefit from better compliance, less paperwork, and faster tax recovery.

Need help choosing a ZRA Integrated Accounting Software for your business? Contact us.