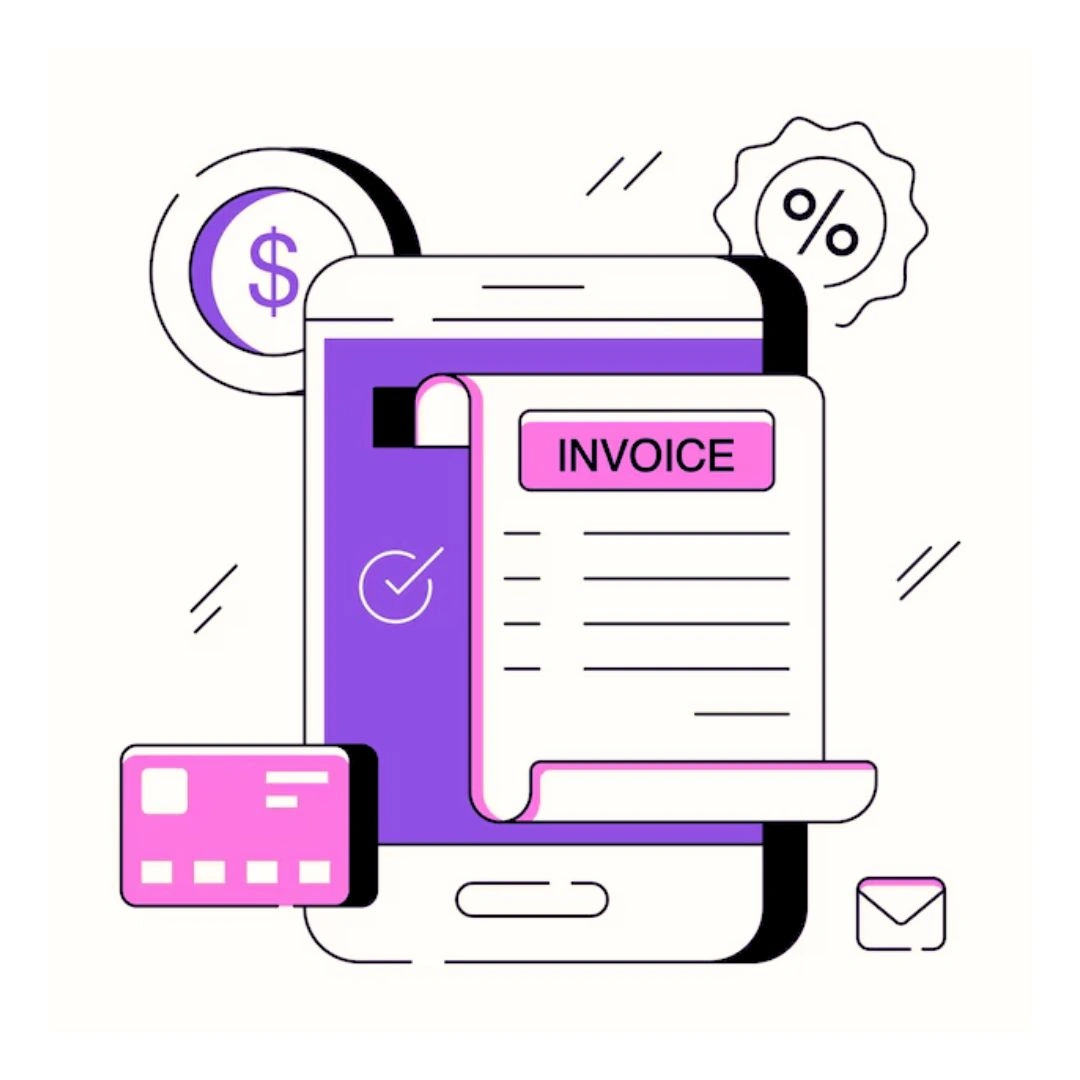

Why Mobile App Engagement Matters for Business Growth?

ERP Accounting Software for Small Businesses in Zambia

Running a small business in Zambia today means dealing with rising competition, strict tax compliance, and the need for accurate financial control. Manual bookkeeping or disconnected tools often lead to errors, delays, and missed opportunities. This is where ERP accounting software becomes a game-changer for small and growing businesses.

What Is ERP Accounting Software?

An ERP system accounting solution combines core accounting functions with other business operations such as inventory, sales, purchasing, payroll, and reporting—all in one platform. Unlike basic tools, accounting ERP software gives business owners a real-time, end-to-end view of their finances and operations.

For Zambian SMEs, especially those registered with ZRA, this integration helps ensure compliance, accuracy, and scalability.

Why Small Businesses in Zambia Need ERP Accounting Software

Many small businesses still rely on spreadsheets or standalone accounting tools. While these may work initially, they often fail as the business grows.

Here’s why ERP accounting software is essential:

- Centralized financial control

All transactions—sales, expenses, inventory, and taxes—are recorded in one system. - ZRA compliance made easier

ERP solutions can support tax reporting, invoicing, and audit readiness. - Reduced errors and duplication

Automated entries replace manual data input. - Better decision-making

Real-time reports show cash flow, profit margins, and outstanding payments.

ERP Accounting Software for Manufacturing Businesses

Manufacturing businesses face unique challenges such as raw material tracking, production costing, and inventory valuation. Generic accounting tools are often not enough.

Accounting software for manufacturing within an ERP system helps by:

- Tracking raw materials, work-in-progress, and finished goods

- Calculating production costs accurately

- Managing suppliers and purchase orders

- Linking inventory movements directly to accounting records

For factories and workshops in Zambia, accounting software for manufacturing business operations ensures better cost control and improved profitability.

Cloud Advantage for Small Businesses

A major shift today is toward small business cloud accounting software. Cloud-based ERP accounting systems allow business owners to access data anytime, anywhere—whether from Lusaka, Ndola, or on the move.

Benefits of Cloud-Based ERP Accounting

- No heavy IT infrastructure or servers

- Automatic software updates

- Secure data backup

- Easy collaboration with accountants and auditors

- Lower upfront costs compared to on-premise systems

For small businesses with limited resources, cloud ERP is both practical and cost-effective.

Key Features of the Best ERP Accounting Software

When choosing the best ERP accounting software for your business in Zambia, look for these essential features:

1. Core Accounting & Finance

- General ledger

- Accounts payable & receivable

- Bank reconciliation

- Expense management

2. Inventory & Stock Management

- Real-time stock tracking

- Low-stock alerts

- Inventory valuation

3. Invoicing & Billing

- Professional invoices

- Tax-ready formats

- Customer payment tracking

4. Manufacturing & Operations (If Applicable)

- Bill of materials (BOM)

- Production planning

- Cost accounting

5. Reporting & Analytics

- Profit & loss statements

- Cash flow reports

- Custom financial dashboards

An integrated accounting ERP system ensures these features work together seamlessly.

ZRA Smart Invoice and Digital Compliance

ZRA has increasingly focused on digital tax monitoring, including the Smart Invoice System. This system ensures that sales are recorded accurately and that VAT is properly reported.

For eCommerce businesses, compliance may involve:

- Using approved invoicing systems

- Issuing digital tax invoices

- Maintaining electronic sales records

Failure to comply with smart invoicing requirements can trigger audits and penalties.

Filing Tax Returns Through ZRA e-Services

ZRA requires most tax filings to be done through its online e-filling portal. eCommerce businesses must submit:

- Monthly VAT returns (if VAT-registered)

- Income tax returns

- Turnover tax declarations

- Withholding tax returns (where applicable)

Late filing or non-submission can attract:

- Penalties

- Interest charges

- Tax compliance restrictions

Maintaining an internal calendar for filing deadlines is strongly recommended.

ERP System Accounting for Compliance and Growth

Compliance is a major concern for businesses in Zambia. An ERP system accounting solution supports:

- Accurate financial records

- Easy preparation for audits

- Better tax reporting and documentation

Beyond compliance, ERP systems help businesses scale. As sales grow and operations expand, the system adapts without the need to switch software.

Who Should Use ERP Accounting Software?

ERP accounting software is ideal for:

- Small and medium businesses

- Manufacturing and trading companies

- Retailers and wholesalers

- Service-based businesses planning to scale

Whether you are just starting or already growing, accounting ERP solutions provide the structure needed for long-term success.

Choosing the Right ERP Accounting Software in Zambia

Before selecting a solution, consider:

- Does it support small business needs?

- Is it cloud-based and scalable?

- Does it fit manufacturing or trading requirements?

- Is local tax and compliance support available?

- Is the pricing affordable for SMEs?

The best ERP accounting software is one that aligns with your business size, industry, and growth plans—not just the most expensive option.

Empowering Small Businesses with Smart ERP Accounting

Choosing the right ERP accounting software can transform how small businesses in Zambia manage their finances, operations, and growth. By centralizing accounting, inventory, and reporting in one system, businesses gain better control, accuracy, and compliance while preparing for future expansion. With the right solution and expert support from Voxforem, small businesses can move confidently toward smarter financial management and long-term success.