Why Mobile App Engagement Matters for Business Growth?

Running a small business in Zambia isn’t easy. Whether you manage a retail shop, a wholesale outlet, a small manufacturing unit, or a service-based company, keeping your finances organised can quickly become overwhelming. Many business owners still depend on manual books, spreadsheets, or outdated tools, which often leads to errors, lost invoices, and time-consuming reconciliations.

Why Small Businesses in Zambia Need Smarter Accounting Tools

The marketplace in Zambia has become more competitive than ever. Customers expect faster service, accurate billing, and smooth transaction processes. When businesses rely on manual bookkeeping, mistakes can follow quickly—miscalculations, missing receipts, and delayed invoice payments.

Using easy accounting software for small businesses solves these problems by reducing human error and simplifying financial tasks. Business owners can track income and expenses in real time, generate reports instantly, and even access financial data from anywhere using cloud-based systems. Instead of spending hours balancing accounts at month-end, they can focus on growth, operations, and customer service.

Key Benefits of Using Online Accounting Software

Modern online accounting software for small businesses comes with features that streamline everyday financial tasks. Here are some of the major advantages:

1. Real-Time Financial Tracking

Every sale, purchase, or expense gets updated automatically. You always know your cash flow status, which helps with planning and budgeting.

2. Faster, Professional Invoicing

Manual invoicing can be slow and prone to errors. Digital systems generate invoices in seconds, helping businesses get paid on time.

3. Better Accuracy in Bookkeeping

Software reduces mistakes that typically occur in handwritten or Excel-based bookkeeping systems.

4. Inventory and Stock Control

Retailers and wholesalers, in particular, benefit from inventory and invoice software for small businesses. You always know what’s in stock, what needs replenishing, and what items are selling the fastest.

5. Secure, Cloud-Based Access

No more lost papers or damaged files. Your data stays safe, backed up, and accessible anytime-whether you're in the office or traveling.

6. Professional Record-Keeping for Audits & Compliance

Accurate records make tax filing, audits, and reporting easier and more transparent.

Essential Features to Look for in the Best Bookkeeping Software

Not all tools are created equal. Some systems focus only on invoicing, while others offer full accounting and inventory features. When choosing the best bookkeeping software for small business, consider the following:

✔ User-Friendly Interface

Business owners without accounting knowledge should be able to use it easily. Menus must be simple, and tasks like invoice creation and expense entry should take only seconds.

✔ Multi-User Access

Your team-sales staff, managers, or accountants-should access the software with proper permissions.

✔ Inventory Management

Look for stock tracking, batch numbers, pricing controls, purchase orders, and supplier management. This is essential for FMCG, hardware stores, supermarkets, agro dealers, and wholesalers.

✔ Automated Reports

Good software can generate profit & loss statements, balance sheets, tax reports, and sales summaries instantly.

✔ Online & Offline Capability

Systems that sync data even when the internet is slow or unavailable are ideal for Zambian businesses.

✔ Secure Data Backup

Automatic backups protect your information from loss, corruption, or system failures.

✔ Mobile Access

Having your accounting data on your phone helps you manage your business on the move.

How Quick Accounting Software Saves Time and Money

When all your financial work is done in one platform-sales, expenses, payroll, inventory, and reporting-it eliminates the need for multiple tools or manual books. Small businesses often spend several hours each week reconciling bills, checking stock, or preparing invoices. A modern system cuts this time dramatically.

Instead of paying additional staff for bookkeeping tasks, you can automate most processes. Many businesses in Zambia report saving up to 40% of their administrative workload after switching to a reliable accounting system. The software practically becomes a digital accountant-minus the salary.

Why Cloud-Based Accounting Is Becoming Popular in Zambia

Cloud technology is no longer complicated or expensive. With affordable internet access and mobile connectivity improving across Zambia, more SMEs prefer cloud-based systems because:

For business owners with multiple locations—like wholesalers, supermarkets, hardware stores, and FMCG distributors—cloud solutions are extremely beneficial.

How the Right Accounting Software Helps Small Businesses Grow

Growth requires control. When you understand your money-where it comes from, where it goes, and how much profit you’re actually making-you can make smarter decisions.

The right tool helps you:

With accurate numbers, planning becomes easier. Forecasting improves. And your business becomes ready for the next stage-expansion.

Choosing the Best Tool for Your Business

Every business has different needs. Some require advanced inventory features; others need strong invoicing or multi-currency support. What matters most is choosing a tool that matches your operations and offers long-term scalability.

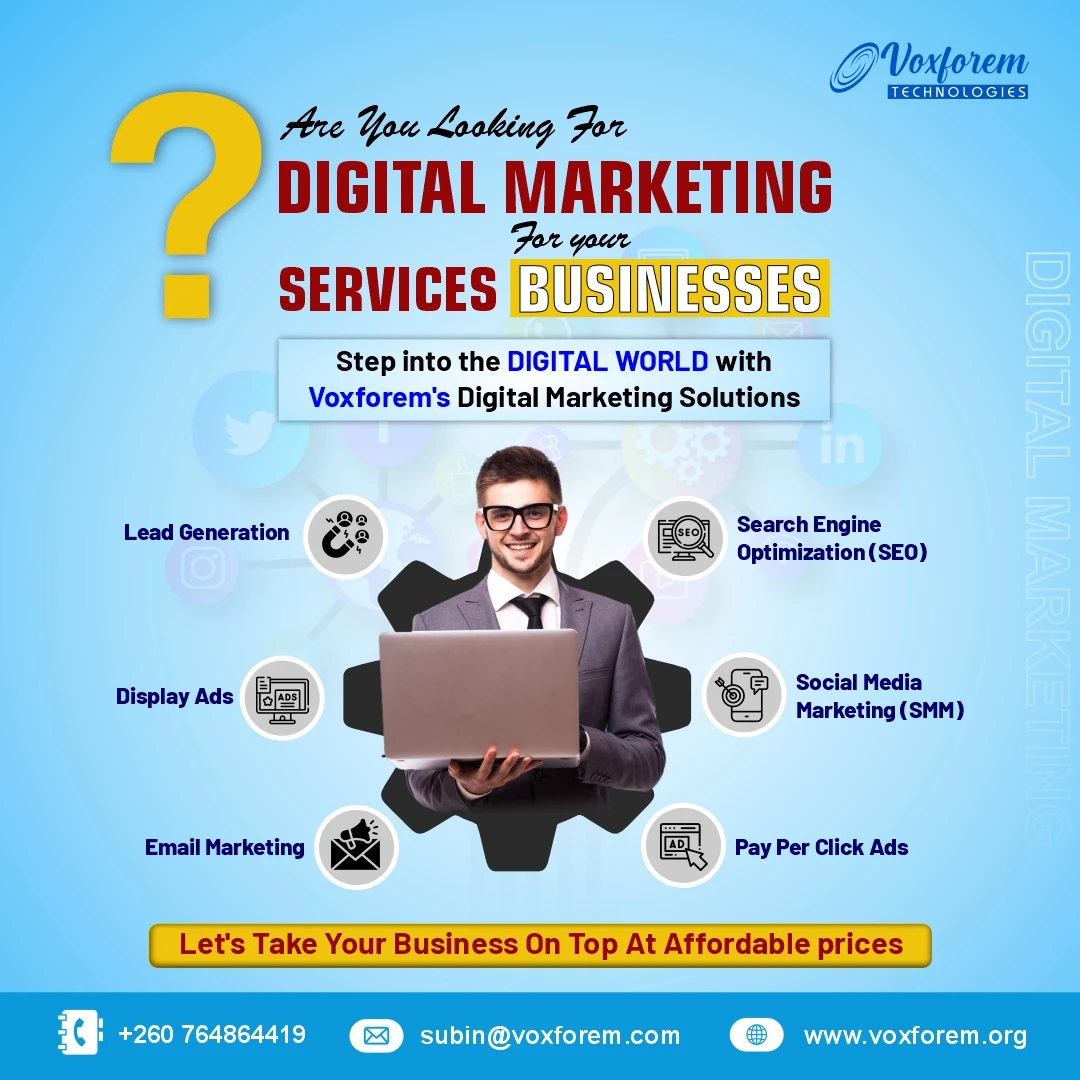

The Smarter Way Forward for Small Businesses in Zambia

Choosing the right accounting software for small businesses is no longer just a convenience-it's a necessity for staying competitive in today’s fast-moving market. With reliable tools that simplify invoicing, track inventory, and maintain accurate financial records, business owners can spend less time on paperwork and more time growing their company.

By adopting a modern, easy accounting software for small business, you gain better control, improved accuracy, and a clear view of your financial performance. Whether you're just starting out or looking to streamline operations, a smart digital solution-offered by providers like Voxforem Technologies - can make a significant difference in your long-term success.