Benefits of Loan Management Software

The financial landscape is constantly evolving, with technology at the forefront of these changes. Loan Management Software (LMS) has emerged as a game-changer for banks, borrowers, and lenders, offering a wide array of benefits that enhance operational efficiency, reduce risk, and improve the overall lending experience. In this blog, we will explore the numerous advantages that LMS brings to financial institutions, demonstrating how it empowers them to better serve their customers and drive business success.

Streamlined Loan Origination

Loan origination can be a complex and time-consuming process, involving countless documents and manual data entry. LMS simplifies this process by the collection and verification of borrower information. This not only reduces the time required to process loan applications but also minimizes the risk of human errors. Streamlined origination allows banks and lenders to efficiently serve a larger volume of clients.

Enhanced Risk Management

Risk assessment is a fundamental aspect of lending. LMS employs advanced algorithms and data analytics to assess credit risk, evaluate a borrower's ability to repay, and identify potential default risks. This data-driven approach allows banks and financial lenders to make more informed lending decisions, reducing the likelihood of non-performing loans and enhancing the overall quality of their loan portfolios.

Efficient Loan Servicing

The journey doesn't end once a loan is approved; efficient servicing is vital. LMS automates various aspects of loan management, such as tracking payment schedules, managing amortization, and maintaining records. This reduces the administrative burden on financial institutions and empowers borrowers to access their loan information independently through user-friendly online portals.

Improved Customer Experience

LMS enhances the customer experience by providing borrowers with a transparent and efficient lending process. Borrowers can track the status of their applications, view their loan terms, and access important documents online. The real-time communication features allow borrowers to get quick responses to inquiries and resolve issues promptly. These improvements build trust and loyalty, ensuring that customers have a positive experience throughout their lending journey.

Personalized Loan Options

Loan Management Software leverages data analytics to assess a borrower's financial situation and offer personalized loan options. This not only increases the likelihood of loan approval but also ensures that borrowers receive loan products that best suit their needs, such as lower interest rates or longer repayment terms. Personalization is a key driver of customer satisfaction and loyalty.

Paperless Documentation

Traditional loan applications often required borrowers to submit physical copies of documents, leading to delays and increased administrative work for banks and lenders. LMS allows borrowers to upload digital documents, streamlining the process and reducing paperwork. This environmentally friendly approach not only saves time but also reduces costs associated with physical document handling.

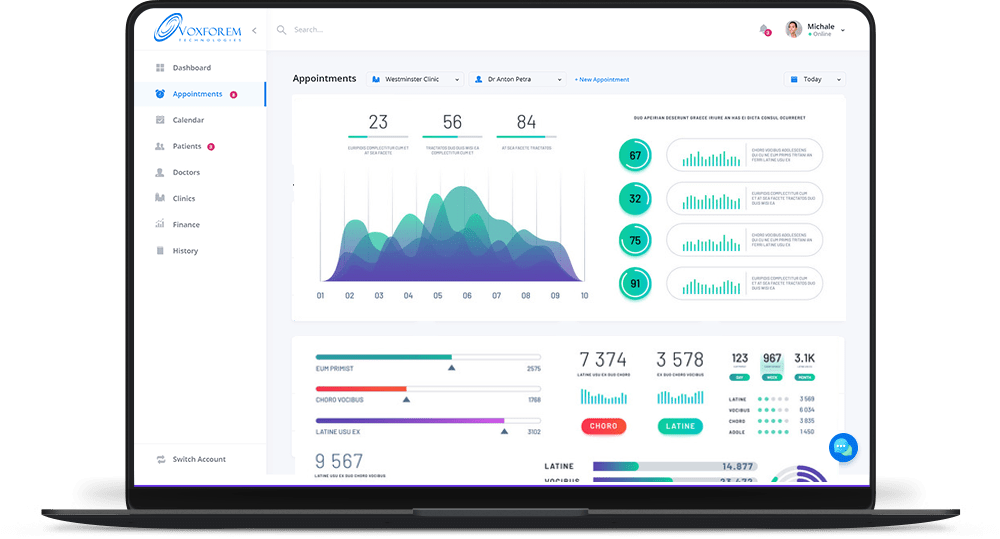

Comprehensive Reporting and Analytics

Loan Management Software provides banks and financial lenders with in-depth reporting and analytics tools. These tools help institutions monitor their lending portfolio, track loan performance, and identify trends. Insights obtained from this data enable banks to make informed decisions, such as adjusting interest rates or modifying lending criteria. This data-driven approach improves the institution's ability to manage its lending operations effectively.

Faster Loan Approval

Automation within the loan origination process significantly reduces the time required for loan approval. Borrower information is processed swiftly, ensuring that applicants no longer need to endure long waiting periods. This rapid approval process attracts more borrowers, as they seek the convenience and quick responses that LMS offers.

Enhanced Security

Data security is a top priority for banks and financial lenders. Loan Management Software employs robust encryption and secure storage to protect sensitive borrower information. This ensures that data breaches and privacy concerns are minimized, allowing borrowers to have confidence in the security of their financial information.

Mobile Accessibility

The rise of mobile technology has transformed the way people access and manage their finances. LMS typically includes mobile applications that empower borrowers to manage their loans on the go. Whether it's checking balances, making payments, or requesting assistance, mobile accessibility enhances the overall lending experience and meets the expectations of modern borrowers.

Enhanced Reporting for Investors

For financial lenders who sell loans to investors, LMS provides advanced reporting features to showcase the performance of loan portfolios. This transparency is invaluable when attracting and retaining investors, as it allows them to make informed decisions regarding their investments.

Cost Reduction

The automation and efficiency offered by LMS often result in significant cost reductions. Fewer administrative resources are required for loan origination and servicing, while the risk of non-performing loans is reduced. Additionally, the cost savings from reduced paperwork, such as printing and physical document storage, can be substantial.

Scalability

LMS is scalable and can adapt to the needs of banks and financial lenders of all sizes. Whether it's a small community bank or a large national lender, the software can be customized to accommodate the institution's specific requirements, making it a versatile solution for the entire industry.

Competitive Advantage

In an increasingly digital and competitive financial landscape, embracing Loan Management Software gives banks and lenders a significant advantage. It allows them to offer a more efficient and customer-centric lending experience, which can be a crucial differentiator in attracting and retaining borrowers.

Conclusion

Loan Management Software has transformed the way banks and financial lenders operate. From streamlining loan origination and improving risk management to enhancing customer experiences and reducing operational costs, LMS is a transformational tool that empowers institutions to thrive in the modern financial landscape. By embracing technology and automation, banks and lenders can offer borrowers a more efficient and transparent lending experience while improving their profitability and competitiveness in the industry.